How ComplyControl Helps Companies Navigate AI Risks With Confidence

Generative AI is a highly powerful tool when it comes to transforming how compliance teams work. It speeds up research, reduces manual checks, and helps analysts focus on the highest-risk cases. But as useful as it is, AI also brings new challenges, especially for highly-regulated industries like banking, where accuracy and trust are absolutely essential.

At ComplyControl, we work closely with clients who operate in compliance-heavy environments, so we see firsthand which AI risks matter most and how to manage them effectively.

In this article, we’ve decided to provide a straightforward breakdown of the key risks our customers face — and how we help reduce them.

1. AI Hallucinations

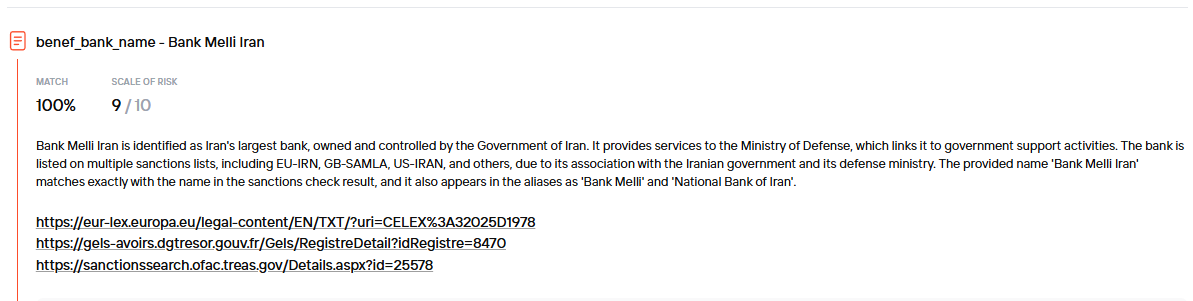

One of the biggest concerns often raised in conjunction with generative AI is “hallucination”: when a model produces information that looks correct but isn’t. In compliance, this issue is felt even more acutely, seeing as just a small inaccuracy can create serious problems. A fabricated link between two entities or a misread bit of regulation could lead to wrongful customer blocks or — on the other end — missed criminal activity.

This is why we rely on the latest models with extremely low hallucination rates and back them with multiple validation layers. We combine AI with rule engines, use confidence scoring, and always keep human specialists in the loop. AI can handle the heavy lifting, but it’s important that when it comes to decision-making, people get the final say.

2. Ensuring Every Result Is Explainable

Regulators increasingly expect clarity from AI models. Which means that compliance teams need to know why a decision was made, not just that it was.

At ComplyControl, we build explainability directly into our platform: every result comes with human-readable reasoning that clients can easily check for themselves. This applies across the entire compliance cycle: onboarding, screening, monitoring, and beyond.

We also use multiple data sources where possible to produce the most accurate, transparent results.

3. Protecting Data Privacy and Confidentiality

Compliance platforms handle sensitive information, so data privacy is non-negotiable. Improper use or storage of KYC or transaction data can lead to grave legal and reputational consequences.

Our team follows strict data-minimisation principles, anonymising data where possible, and offering locally hosted LLM options for clients with higher privacy requirements. Our security framework includes GDPR alignment, ISO27001-based controls, encryption, role-based access, and strong vendor due diligence standards.

4. Avoiding Over-Reliance on Automation

To reiterate once again: while AI is powerful, it should never replace human judgment. Without proper oversight, teams risk missing subtle signals or new fraud patterns.

In this sense, ComplyControl’s approach is simple, but effective: AI prepares the analysis, but humans remain the decision-makers. Tiered alerts, customizable rules, and institution-specific policies ensure that automation supports the compliance function, but does not replace it.

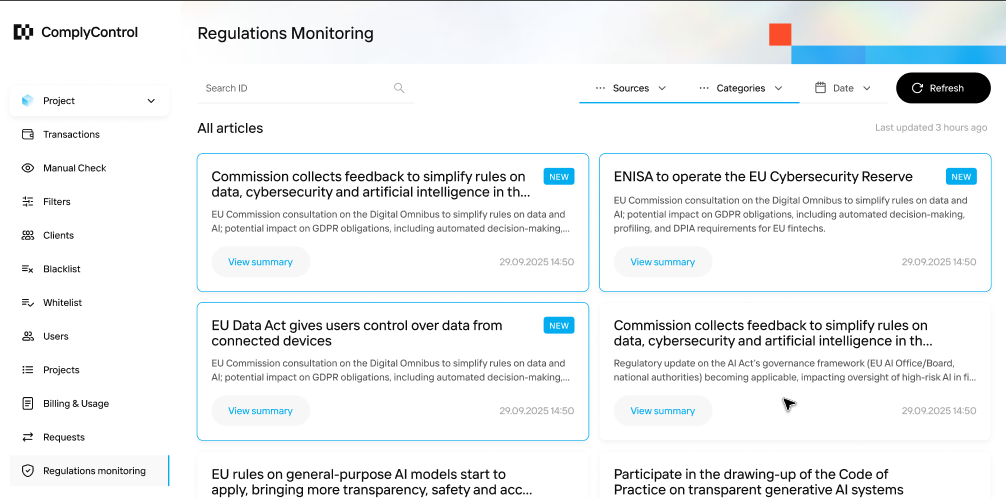

5. Keeping Up With Rapidly Changing Regulations

AI regulation is evolving fast, so it’s quite natural that many companies worry about investing in tools that may not meet future requirements.

To solve this, we offer an AI-powered Regulations Horizon Scanner that continuously tracks the regulatory landscape. It can alert teams of any legal changes relevant to them, helping update policies and procedures before there is an issue.

This keeps businesses compliant, proactive, and ready for whatever comes next.

In short, AI brings tremendous opportunities, but only when implemented responsibly. At ComplyControl, we make it a key point to help our client companies embrace these benefits while staying accurate and secure.

If you’d like to see how we can support your compliance team, we’re always happy to talk.